6/28/2023

| SHARE

Posted in Canada Living by Vanguard Realty | Back to Main Blog Page

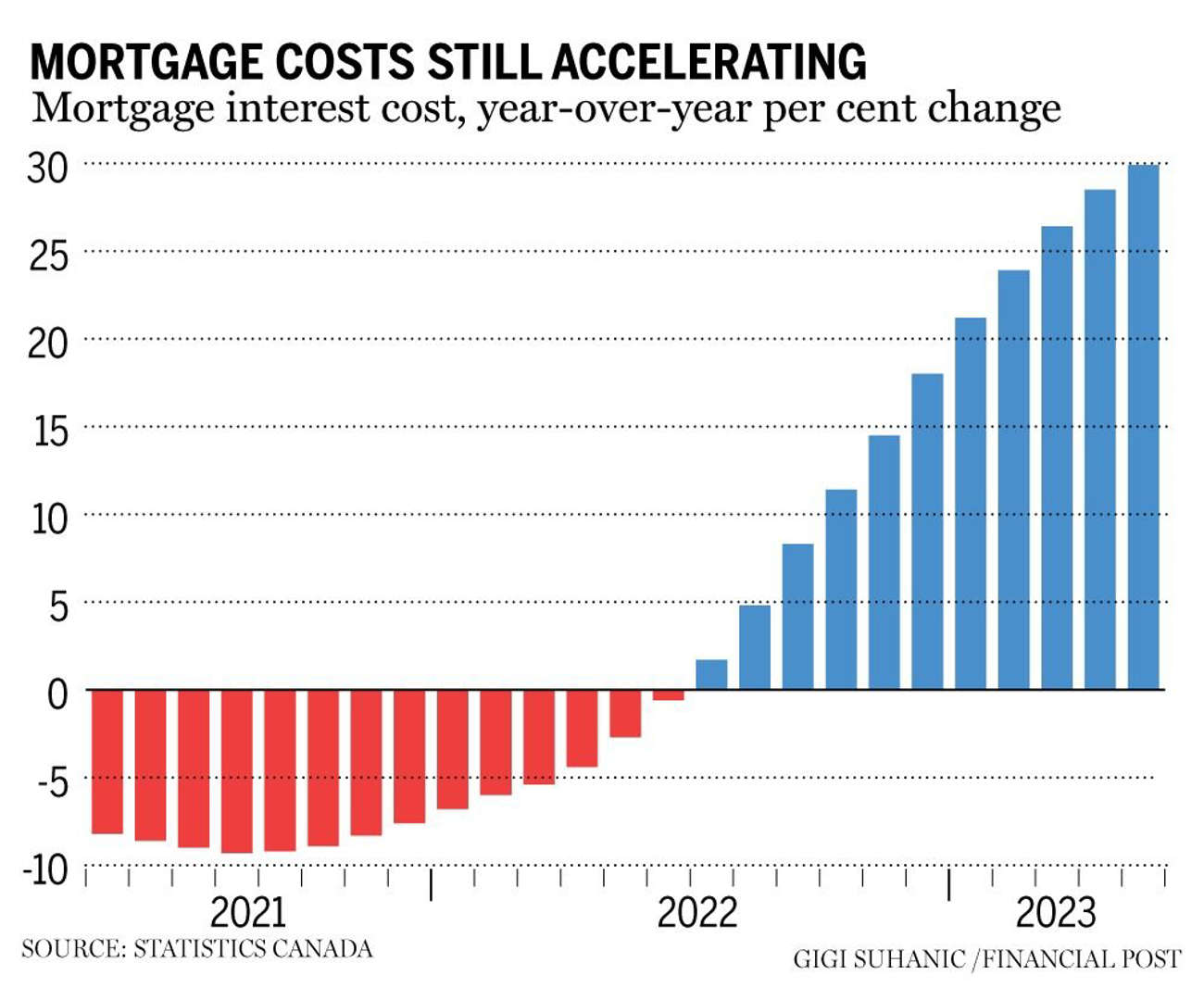

Inflation cooled on a month-over-month basis in May, but one factor that has been unrelenting in driving the consumer price index higher is mortgage interest costs — and the pressure is showing no signs of abating.

The latest CPI figures , released by Statistics Canada on June 27, showed the upward trend in housing expenses was the single biggest contributor to the month’s 3.4 per cent inflation rate.

Mortgage interest costs surged 29.9 per cent in May as compared to a year ago, when they had fallen by 2.7 per cent. May now marks the eleventh consecutive month of rising mortgage interest expenses, the fifth consecutive month where year-over-year increases have exceeded 20 per cent and the third consecutive record increase.

“(The rise in) mortgage interest cost is unprecedented because rates haven’t moved as quickly in a very long time,” Benjamin Reitzes, managing director of Canadian rates and macro strategist at the Bank of Montreal, said.

Reitzes said the long-term averages of prices take time to stabilize, so he expect there is “probably is still more upside to come.”

“‘Have we seen the top here at 29.9 per cent year over year?’ We might be close,” he said. “The big increases in rates started in June of last year, so you might get a little bit further increase over the next month or two but then after that, you’ll likely see some slowing, but not a lot.”

For prospective homebuyers, the surge in mortgage interest costs mean larger monthly payments and reduced purchasing power. According to Reitzes, this situation has made it increasingly challenging for aspiring homeowners to enter the housing market or to upgrade their existing properties.

“Higher (mortgage) rates are still likely for variable rate mortgages, and we’ll see where the fixed rates end up,” Reitzes said. “But given where inflation is and the Bank of Canada showing no signs of any willingness to back off at this point, expect mortgage rates to stay not far from current levels, which makes affordability challenging for sure.”

May’s inflation rate was a full percentage point below the surprise 4.4 per cent mark registered in April, a decline that has some economists predicting the Bank of Canada may now back off from raising interest rates further. But Reitzes is not so sure.

“Even excluding mortgage interest costs, inflation is still well above the Bank of Canada’s target and is likely still quite uncomfortable for them and high enough to get them to likely push rates higher one more time in July,” he said.

In February, the central bank emphasized the importance of achieving the two per cent inflation target to restore the price stability that Canada has enjoyed over the past three decades.

On June 7, the bank implemented another 0.25 per cent increase in the overnight rate, which led to a policy interest rate of 4.75 per cent. The next 2023 interest rate announcement is scheduled for July 12.

Source: MSN Money

Canada Living, Canadian Households, Household Debt, Mortgage Consumers, Mortgage Interest Costs