12/13/2019

| SHARE

Posted in Home Buyers by Vanguard Realty | Back to Main Blog Page

Millions of Canadian millennials feel they may never be able to follow previous generations into homeownership according to a new survey.

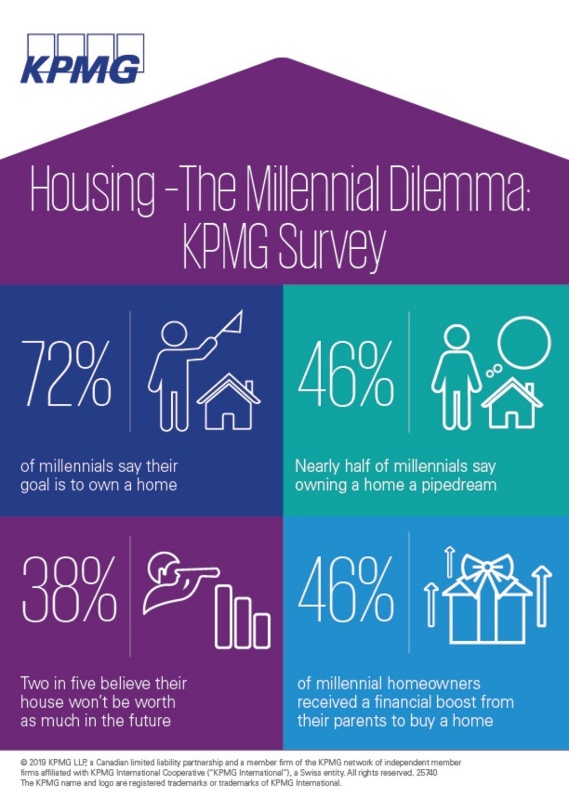

KPMG Canada’s poll reveals that 72% of millennials want to own a home but 46% say it is a pipedream due to Soaring house prices and rising debt – including high levels of student debt, which is stifling financial goals despite higher incomes than previous generations.

"The combination of rising house prices, high levels of personal debt and annual incomes that are just a fraction of the cost of buying a home compared with their parents' generation, is pushing the dream of home ownership out of reach for many millennials," says Martin Joyce, Partner, National Leader, Human & Social Services, KPMG. "This is particularly challenging in the markets of Vancouver and Toronto."

Among those who are already homeowners, almost half received a financial boost from their parents but more than a third are concerned that their largest asset will not be worth as much in the future.

Meanwhile, saving for a down payment now takes an average 13 years compared to just 5 years in 1976 according to figures from Statistics Canada.

"That's eight fewer years that millennials might have for saving more for their retirement," Mr. Joyce says. "If they do manage to save up and buy a house now and delay retirement savings, our poll finds 65% of millennials fear they won't have enough saved for retirement."

Millennials are the most educated generation but that has come with a price, student debt. Combined with the larger mortgages required to buy a home in recent years, this cohort’s finances are being squeezed despite higher incomes. That means they are not necessarily better off than previous generations.

Debt-to-income ratio is a key financial indicator and, for young millennials, that now stands at 216 per cent, far exceeding the 125 per cent for Gen-Xers and 80 per cent for baby boomers at the same age – primarily because of mortgage debt. Wage growth has also been slower than expected, the Bank of Canada has warned.

Government action demanded

A majority of all the generations surveyed in the KPMG poll wants Ottawa to take action such as:

- make housing more affordable;

- make it easier to use RRSPs for down payments;

- raise TFSA limits; and,

- implement a new registered savings system, like RESPs for education savings, to make housing more affordable.

"It seems pretty clear that millennials are in a unique situation in terms of their ability to purchase a home – which has historically been a foundation for retirement stability – and most Canadians agree that the government has a role to play in making it a more achievable dream for many of them," Mr. Joyce says. "It's time to have a national conversation."

Canadian Real Estate Market Outlook, First Time Home Buyers, Home Buyers, Home Ownership, Millenials