Fixed mortgage rates expected to surge as bond yields reach 16-year high

9/22/2023

| SHARE

Posted in Mortgage Interest Rates by Vanguard Realty | Back to Main Blog Page

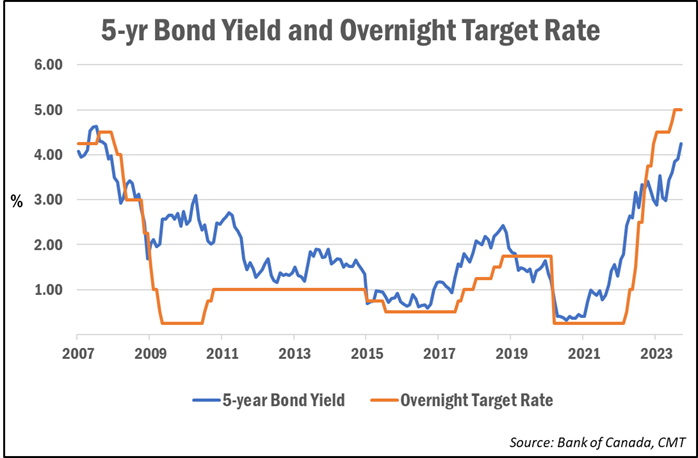

Fixed mortgage rates could surge higher in the coming week after Government of Canada bond yields—which lead fixed mortgage rates—shot up to a 16-year-high.

Rate-watchers say mortgage providers could hike rates by anywhere from 20 to 30 basis points (0.20% to 0.30%).

“Fixed rates should be up 20 bps on this news, however if the bond yield keeps climbing, more is on the table,” Ryan Sims, a TMG The Mortgage Group broker and former investment banker, told CMT.

With most mortgage rates now above 6%, Sims believes 5-handle rates (those in the 5% range) could largely be gone by next week, aside from some special rate offers.

Ron Butler of Butler Mortgage tweeted that he expects mortgage rate increases ranging from 25 to 30 bps. And, since lenders don’t generally adjust their rates all at once, he added, “it will take until the end of next week until all the increases are published.”

Yields were up to levels not seen since 2007 following this week’s higher-than-expected inflation reading in Canada and comments from the U.S. Federal Reserve, both of which suggested that interest rates could remain elevated for longer than anticipated.

The bigger question: when are the rate cuts expected?

While markets are currently pricing in slight odds of two more rate hikes before the end of the year, most experts believe the central bank has just one more quarter-point left in its tank. And all of the big bank forecasts continue to believe the Bank is now done with its rate-hike cycle.

But more importantly, says mortgage broker Dave Larock, is the timing of the Bank’s first expected rate cuts.

Markets are now pushing back expectations for the first rate cuts to the latter half of 2024.

“To me, the more the more powerful question to be asking now is when are we going to see cuts? Because one more quarter-point hike, incrementally on a proportional basis, is pretty small,” he told CMT. “The question is how long are they going to keep the tourniquet this tight?”

Historically, he said the gap between the Bank of Canada’s last rate hike and its first rate cut is roughly 10 months.

“That’s one reason we want to know if the BoC is finished hiking, because we want to know if the clock started on the gap period between its last hike and its first cut,” he said. However, he noted that 10 months is not a rule and can vary drastically between rate-hike cycles.

The impact of higher interest costs

Growing expectations of a “higher for longer” interest rate environment will impact both variable-rate borrowers and those purchasing or renewing existing mortgages at these elevated rates.

Survey results released this week by Mortgage Professionals Canada found that 65% of mortgage holders expect to renew their mortgage in the next three years, with more than two thirds (69%) saying they are anxious about the thought of renewing at a higher mortgage rate.

The rate hikes to date have meant debt-servicing costs are rising to record levels. The monthly mortgage payment required to purchase the typical home has now risen to $3,600 a month, according to Ben Rabidoux of Edge Realty Analytics. That’s a 21% increase from a year ago and up 80% over the past two years.

Meanwhile, a recent report from Oxford Economics found that the interest-only debt-service ratio rose to 9.9% in the second quarter, its highest level since 2007.

“Our modelling shows that household interest payments as a share of disposable income will rise to 10.3% in the coming months,” the report noted. “We expect highly indebted households will cut spending as they deleverage and pay down debt, which should put the principal portion of the debt service ratio on a downward trajectory.”

Source: Canadian Mortgage Trends

Fixed Rate Mortgages, Mortgage Consumers, Mortgage Rates, Mortgage Rates Canada, Mortgage Refinancing

Thinking of buying or selling a property, or have a question regarding the real estate market? Fill out the form below and we'll get back to you promptly.