2/28/2024

| SHARE

Posted in Interest Rates by Vanguard Realty | Back to Main Blog Page

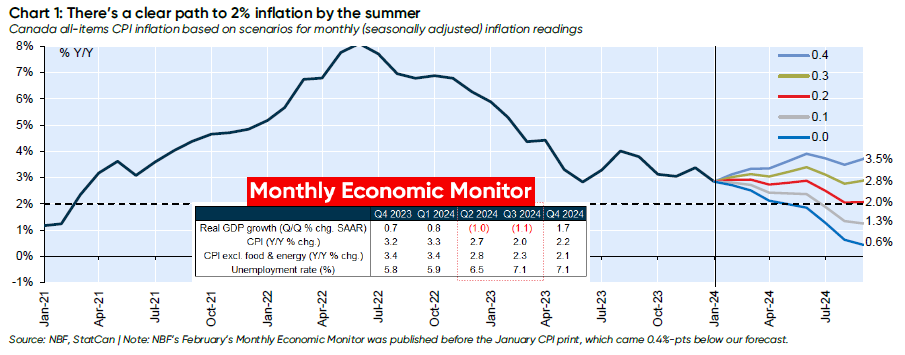

Could Canada’s headline inflation rate reach the neutral target of 2% by this summer, a full year sooner than the Bank of Canada’s own forecasts?

National Bank of Canada thinks so.

In a new report, economist Taylor Schleich argues that there’s actually a “clear path” to 2% inflation by the middle of this year.

“To get 2% inflation, one doesn’t need to assume inflation decelerates at all from the recent run-rate,” he writes. “Indeed, simply plugging in the average monthly increase from the past six months (+0.2%) brings you right to target in Q3.”

He notes that that’s even with the “problematic” shelter inflation, which continues to run more than 6% above year-ago levels and is the leading contributor to headline inflation right now.

This is also based on National Bank’s expectation that GDP growth will turn negative in both the second and third quarters of 2024.

In January, Statistics Canada reported that headline CPI inflation fell more than expected to an annualized 2.9% from 3.4% in December.

Should the now-negative output gap—which is the difference between what an economy actually produces and what it would produce in an ideal world—further slow inflation or if we return to pre-pandemic dynamics, which is a monthly average of +0.15% from 2010 to 2019, Schleich says inflation could return to target even sooner.

This scenario is drastically different from the Bank of Canada’s current forecast released in its January Monetary Policy Report. The Bank maintains that headline inflation won’t return to its desired 2% target until the middle of 2025, and has been adamant that it wants to see “assurance” that inflation is trending back towards its target before considering interest rate cuts.

“The moral of this story is, despite the BoC’s repeated warnings that inflation victory won’t come until next year, there’s a path to 2% that’s shorter and clearer than some may appreciate,” Schleich adds.

What this would mean for Bank of Canada rate cuts

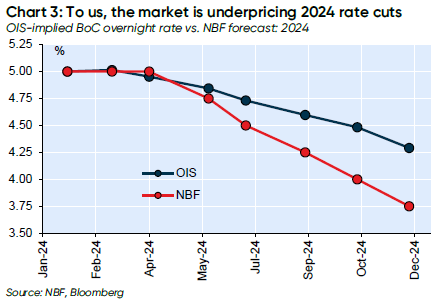

With the potential for inflation to reach its target sooner than expected, National Bank believes the market is “under-pricing” 2024 rate cuts by about 50 basis points (bps).

As a result, National Bank currently sees 125 basis points worth of cuts being delivered in the second half of this year, which would bring the Bank of Canada’s overnight target rate down to 3.75% from its current 5.00%.

“Considering our outlook for the rest of the economy (flat-to-negative growth, a rising unemployment rate), cuts at every meeting in H2 are entirely reasonable,” the report notes. “And while not contained in our base case outlook, one should also factor in the risk of 50 bp cuts along the way, given today’s above-neutral setting.”

Source: Canadian Mortgage Trends

Bank of Canada, Bank of Canada Benchmark Rate, Interest Rate Forecast, Interest Rates