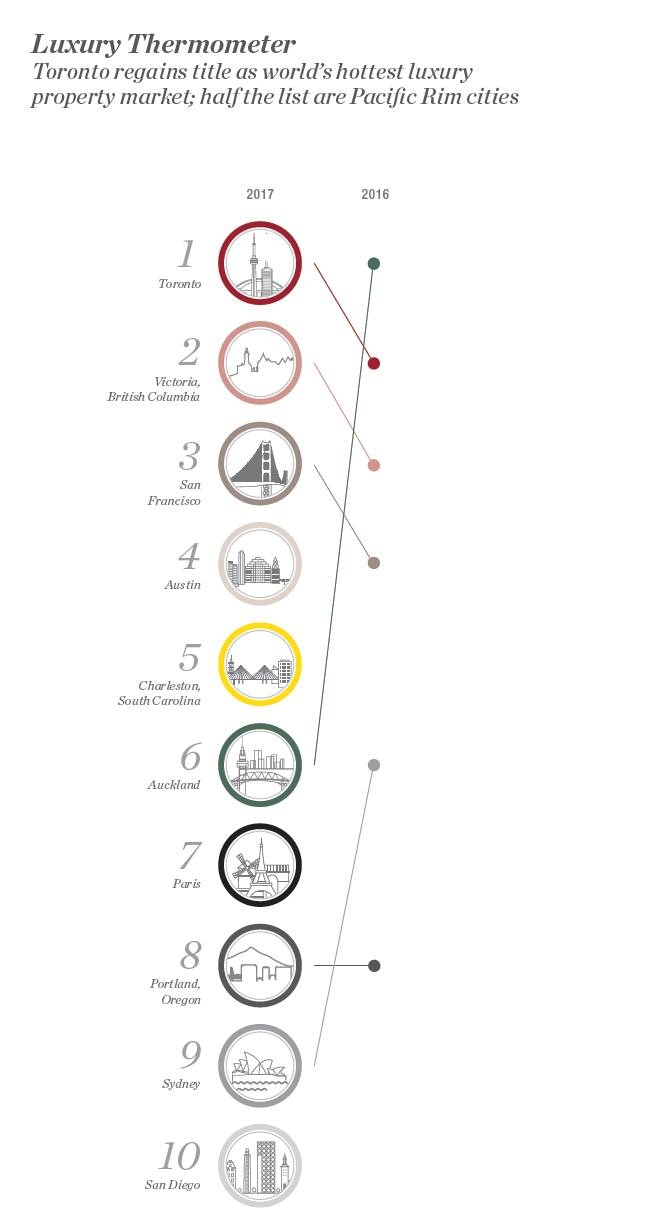

Toronto and Victoria, B.C. are the world’s “hottest” markets for luxury homes as investors flock to Canada for its political and economic stability, according to a new report from Christie’s International Real Estate.

Christie’s CEO Dan Conn told BNN in an interview Wednesday that even with the rise in million-dollar-plus home sales, Toronto is cheap compared to other luxury markets. “I consider Toronto, even with the heat at the upper end of the market, it is still a comparative bargain on the global map,” he said.

Investors interest in Canadian real estate shows no sign of cooling anytime soon, Conn said.

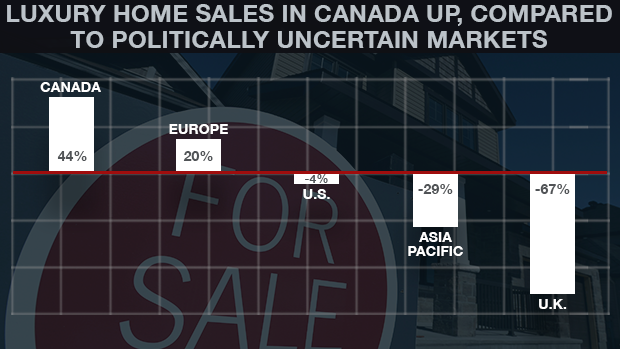

Data Source: ChrIstie's International. Image by Masha Barsky/BNN.

Data Source: ChrIstie's International. Image by Masha Barsky/BNN.

“The reality of the world right now is that, particularly in 2016, we’ve lived through an enormous amount of uncertainty, and one of the real bright lights geopolitically-speaking was Canada,” he said, citing the country’s quality of education, health care, human rights record, and stable government.

“Canada will always be a great place to invest because it will always be a great place to live.”

Hong Kong is now the top luxury residential real estate market in the world, beating London for the first time in five years, but Toronto and Victoria are the globe’s fastest-growing high end markets, the report found. Sales of homes $1 million or more grew by one per cent worldwide, with Toronto and Victoria moving up one spot each to occupy the top two in Christie’s ranking.

The desire for luxury home sales doesn’t seem to be slowing either, according to the report, which saw signs of sustained growth in the high-end market.

Data Source: Chrstie's International. Image by Masha Barsky/BNN.

Data Source: Chrstie's International. Image by Masha Barsky/BNN.

Foreign buyers aren’t the main source of heat in Toronto’s market, and recent efforts by the provincial government to crack down on foreign speculators are unlikely to cool the market, said Conn. Last month, Ontario Premier Kathleen Wynne unveiled measures – including a 15 per cent tax on real estate speculation by non-residents.

Instead, Canadian policymakers should shift their focus to adding more housing supply, Conn said.

“I just don’t see this as a fix for inventory and pricing,” he said, speaking on Ontario’s recent measures aimed at cooling the market.

Conn acknowledged the results in Vancouver’s foreign buyers’ tax implemented in August were notable. However, he doubts the same measures will work in Toronto and noted that most of the purchasing is still coming from domestic buyers countrywide.

“Effectively you are squeezing one end of the balloon and air is going into another end,” he said.

The report, titled Luxury Defined, looked at data from over 100 brokerages across the globe, revealed homes that are seven figures and over peaked last year at records levels.

(Image courtesy of Christie's International)

(Image courtesy of Christie's International)

Source: BNN